Established in 2010, the Volunteer Income Tax Assistance (VITA) program at UC Berkeley is a year-long program that prepares student volunteers to file taxes for low- and moderate-income earning individuals and families in the East Bay. VITA students prepare for the IRS-sponsored VITA Certification Exam and learn about beneficial tax policies in relation to socioeconomic inequality in the fall, then volunteer at community tax preparation sites in the spring.

Tax Filing Resources

Our VITA program is NOT a tax filing service.

If you do need assistance filing out your taxes, we recommend you checking out the following resources:

Special Event

Haven’t filed your 2024 tax return yet? Don’t stress! Sign up for an appointment at VITA’s Pop-Up Tax Event on Friday, 4/11 from 12-4pm and get free assistance from IRS-certified volunteers! Learn more at berkeley vita.notion.site.

Important Dates for Students

|

VITA 2025-2026 Application |

Note: Please email ucberkeleyvita@gmail.com after you submit the application form. |

|

Virtual Info Session |

Thursday, September 4th, 6:30pm-7:30pm |

|

Application Deadline |

Friday, September 17th at 11:59pm |

|

Application Decisions |

Saturday, September 6th |

|

DeCal Class More information – coming soon! Note: All classes will be held in-person. Please contact ucberkeleyvita@gmail.com with concerns about accessibility. |

Required Basic Lecture: Tuesdays, 6:30-8:30pm in Valley Life Sciences Building (VLSB) 2060 Optional Advanced Lecture: Tuesdays. 8:30-9:30pm in Valley Life Sciences Building (VLSB) 2060 |

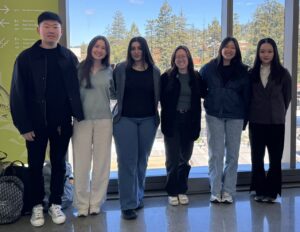

2024-2025 VITA leaders

Supporters

The VITA program has benefited from the generous support of the Associated Students of the University of California, the Center for Financial Reporting and Management, Deloitte, PwC, EY, Moss Adams, and KPMG.

Contact Information

For tax filing help, please refer to the above Tax Filing Resource section. For partnership and general questions about our program, please contact the student directors at ucberkeleyvita@gmail.com.

- Rinrada (Earn) Maneenop, Director of Education and Training, Basic Curriculum

- Nayely Lupercio Puga, Director of Education and Training, Basic Curriculum

- Prishaa Vala, Director of Education and Training, Advanced Curriculum

- Sofia G Arjonilla, Director of Finance

- Naydin Beltran Garcia, Director of Community Partnerships

- Hillary Wu, Director of Community Partnerships

- Nina Parker, Program Manager, nina.parker@berkeley.edu

2024 DeCal class